New points of legal updates – February 2022

This article of February 2022 continues updating notable documents and policies issued by the Government recently. With the spirit of creating favourable conditions to restore production, bring people’s daily life back to a new normal, the Government has issued several regulations aimed at socio-economic stabilization and development.

1. VAT reduction from 10% to 8% in 2022, rental support for employees working in Industrial Zones in accordance with Resolution No.43/2022/QH15 and Resolution No.11/NQ-CP

On 11th Jan 2022, National Assembly has released Resolution No.43/2022/QH15 on financial and monetary policies supporting the Program for socio-economic recovery and development. Not enough 01 months of Resolution 43’s issuance, on 30th Jan 2022, the Government has continued issuing Resolution No.11/NQ-CP on a measure of socio-economic recovery and development. The promulgation of Resolution 11 is an important strategy that specifies financial and monetary policies supporting socio-economic recovery and development according to with the content of Resolution 43. Below are notable points of 2 Resolutions:

- VAT reduction from 10% to 8% in 2022:

VAT on goods and services subject to 10% VAT will be reduced to 8%, excluding the following groups of goods and services: Telecommunications, information technology; finance, banking, securities, insurance; trading of real estate, metal, precast metal products, mining products (excluding coal mining), cokes, refined petroleum, chemical products, goods, and services subject to excise tax.

Guiding regulation: Decree No.15/2022/ND-CP of Government on tax exemption and reduction policy in accordance with National Assembly Resolution No.43/2022/QH15 on fiscal and monetary policies supporting socio-economic recovery and development issued on 28th Jan 2022 and taken effective on 01st Feb 2022.

- Workers in Industrial zones, export processing zones, key economic areas to get housing rental support for three months;

- Effective implementation of policies on preferential lending, such as: Loan to support job creation, job maintenance, and expansion; Loan to individuals and households to buy or rent social housing, worker housing, construction or renovation of housing; loan to private preschool and primary schools; loan to pupils, students to buy online learning equipment; etc.

- Continuous to refinance for the Social Policies Bank so that the employers borrow to pay wages for job stoppage, wages to production recovery to employees;

- Extension of payment terms for the corporate income tax, personal income tax, value-added tax, excise tax, and land rental in 2022.

Both Resolutions take effect from the date of issuance.

2. Facilitation of immigration procedure for foreigners

This is one of the important contents of Official Dispatch No.450/VPCP-QHQT of the Government’s office on granting entry to foreigners, Vietnamese people residing with relatives overseas issued on 18th Jan 2022.

For the competence and procedures of granting entry:

- The foreigners, Vietnamese people residing with relatives overseas who have legal documents on entry (unexpired certificate of visa-free entry, permanent residence card, temporary residence card, visa) shall be entitled to enter Vietnam according to regulations of the Law, without having to re-apply for inspection of identity, grant of visa/visa-free entry, permission for entry from the central or local authorities;

- The foreigners without visa:

The People's Committees of provinces shall consider granting entry to foreigners who do not have visas for the purposes of working, attending conferences, seminars, studying and humanitarian... in their provinces.

The Dispatch No.450/VPCP-QHQT took affective from 18th Jan 2022.

3. New instructions about medical quarantine for passengers entering Vietnam.

At the moment, the instructions about medical quarantine for immigrants have been applied in accordance with the Official Dispatch No.10688/BYT-MT issued by the Ministry of Health on 16th Dec 2021, taken effectively from 01st Jan 2022.

Accordingly, passengers entering Vietnam who are fully vaccinated or recover from COVID-19 must, within 03 first days of arrival:

- Self-monitor health at their places of residence (including houses, guesthouses, resorts, offices of their representative agencies, ...); avoid coming into contact with surrounding people or leaving their accommodations

- Do Covid RT-PCR tests on the 3rd day from the date of entry. If the test result is negative, they should continue to monitor their health until the end of the 14-day period from the date of entry. If the test results are positive, positive cases must be handled according to regulations.

Passengers entering Vietnam that are not vaccinated yet or do not receive full doses of COVID-19 vaccines must:

- Be in quarantine at their places of residence in the next 07 days after the date of their arrival; do Covid RT-PCR tests on the 3rd and 7th day.

- Continue to monitor their health till the end of the 14-day period if they are tested negative. If they are tested positive, further actions prescribed in regulations should be taken.

4. Law on environmental protection has officially entered into force from 01st Jan 2022, and Decree and Circular on guiding articles of the Environment Law have been promulgated.

More than 1 year from the issue date of 27th Nov 2020, Law on environmental protection No.72/2020/QH14 has officially taken effectively since 01st Jan 2022. With the central content throughout is the protection of components in the environment, the people's health, the Law has been hoped to bring positive impacts to society and the community.

On 10th Jan 2022, Decree 08/2022/ND-CP of the Government, along with the Circular No.02/2022/TT-BTNMT of the Ministry of Natural Resource and Environment were issued to promptly elaborate the provision of the Law on Environment.

Decree No.08/2022/ND-CP has 13 Chapters with 169 Articles. Accordingly, the Decree provides guidance on provisions of Law on Environmental Protection on the protection of environmental components; environmental zoning; strategic environmental assessment; environmental impact assessment; environmental license; environmental registration; environmental protection in production, business, service, urban, rural areas and a number of fields; waste management; responsibilities for recycling and handling products and packages of manufacturing or importing organizations and individuals; environmental monitoring; environmental information system and database; prevention and response to environmental incidents; compensation for environmental damage; economic tools and resources for environmental protection; State management, inspection, and provision of online public services on environmental protection.

Meanwhile, Circular No. 02/2022/TT-BTNMT has 7 Chapters with 85 Articles and Appendices, created on the basis of ensuring compliance with the Law on Environmental Protection 2020, Decree No. 08/2022/ND-CP, and other relevant laws, guidelines, and policies of the Party and the State. Accordingly, the Circular ensures consistency and synchronization with other legal documents in the current legal system; the conformity with international treaties to which Vietnam is a member; the conformity with reality, rationality, enhancing transparency, clarity, and accessibility. Additionally, the Circular simplifies administrative procedures and reduces business conditions, changing the state management method from pre-inspection to post-inspection as well as supplementing new regulations to fundamentally overcome difficulties and obstacles arising in practice under the current law on environmental protection. Thereby, the Circular shall create favourable conditions for business investment activities, and at the same time, improve the efficiency of state management and promote online public services and digital transformation.

Both Decree No. 08/2022/ND-CP and Circular No. 02/2022/TT-BTNMT were effective as of 10/01/2022.

5. Amending articles of Law on Enterprise and Investment

On 11th Jan 2022, Law No.03/2022/QH15 of the National Assembly has been issued to amend and supplement a number of articles of Law on public investment, the law on public-private partnership investment, the law on investment, the law on housing, the law on bidding, the law on electricity, the law on enterprise, the law on special excise duty, and the law on enforcement of civil judgments.

Accordingly, this law has amended and supplemented a number articles of the law on enterprise and investment as follows:

- Adding the sector, business line of production, service of network security into the list of sectors and trades subject to conditional business investment;

- Amending and adding Article 49.1 – law on enterprise 2020 on rights of company members.

Law No.03/2022/QH15 shall be taken effectively from 01st March 2022.

6. Cases of compensation for occupational accidents and diseases

From 01st Mar 2022, regulations on compensation levels for occupational accidents and diseases are implemented in accordance with Circular 28/2021/TT-BLDTBXH of the Ministry of Labour, Invalids and Social Affairs issued on 28th Dec 2021. Thus, the cases of compensation for occupational accidents and diseases include:

- The employee suffers an occupational accident that reduces his working capacity by 5% or more or dies without the fault of this employee; except for the cases specified in the Article 4.1 of the Circular 28/2021/TT-BLDTBXH.

- The employee suffers from an occupational disease that reduces his working capacity by 5% or more or dies while working for the employer, or before taking retirement, before quitting the job, before changing to work for other employer (excluding cases that the employee has an occupational disease caused by doing jobs or work for another employer).

7. Policies adjusting the monthly salaries which social insurance premiums have been paid

This is a content of Circular 36/2021/TT-BLDTBXH dated 31st Dec 2021 specifying coefficients for adjustment of monthly salaries and incomes for which social insurance premiums have been paid. Correspondingly, the monthly salaries of the employees paid for compulsory social insurance are adjusted as below formula:

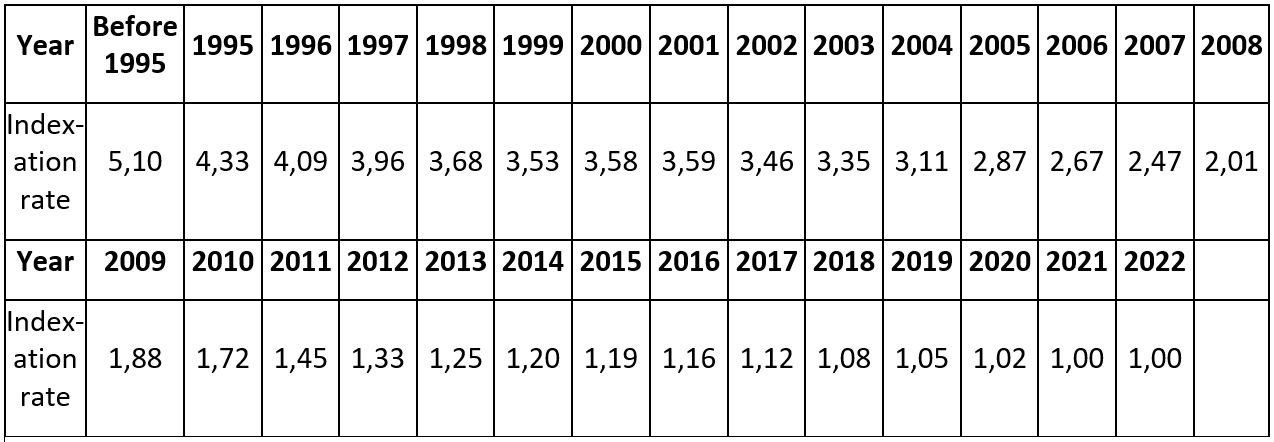

Indexed monthly salary after payment of social insurance contributions of each year = total monthly salary after payment of social insurance contributions in each year x indexation rate of monthly salary after payment of social insurance contributions in the corresponding year

In that formula, the indexation rate of monthly salary after payment of social insurance contribu-tions in the corresponding year shall be hereunder:

The Circular No.36/2021/TT-BLĐTBXH has taken effectively from 20th Feb 2022 and applied from 01st Jan 2022.

8. Maximize working overtime with seasonal labour

According to the Circular 18/2021/TT-BLĐTBXH taken effectively from 01st Feb 2022, maximum working time, overtime of seasonal labour, processing of goods under orders has increased to 12 hours/ weeks and 8 hours/ month.

- Total standard working hours and overtime are not exceeding 12 hours/ day;

- Total standard working hours and overtime are not exceeding 72 hours/ week; (current regulation of 60 hours/ week);

- Total overtime is not exceeding 40 hours/ month (current regulation of 32 hours/ month)

- Total overtime for each employee is not exceeding 300 hours/ year.

9. Increasing retirement pensions, social insurance allowances and monthly benefits from 01st Jan 2022

From 01st Jan 2022, Decree No.108.2021/ND-CP of the Government on adjustment to retirement pensions, social insurance allowances and monthly benefits has been applied for implementation.

Accordingly, the amount of retirement pensions of Dec 2021 payable to the persons prescribed in Clause 1 Article 1 of this Decree increases by 7.4%. The amount of retirement pensions, social insurance allowances and monthly benefits adjusted as prescribed in this Article shall serve as the basis for the next adjustments to the retirement pensions, social insurance allowances and monthly benefits.

10. Failing to contribute to disaster preparedness fund shall be fined up to VND 50 million

Decree No.03/2022/ND-CP has been issued by the Government on 06th Jan 2022 to stipulate penalties for administrative violations against regulations on disaster preparedness, operation and protection of hydraulic structures and flood control systems. Accordingly, the failure to make payment to the disaster preparedness fund shall be fined up to 50 million dongs. Comparison with the old Decree No.104/2017/ND-CP, this Decree 03 has increased the minimum fine of VND 50,000 to VND 300,000 for failure to pay the annual disaster preparedness fund.

In addition, enforced payment of compulsory amounts to the disaster preparedness fund if any person or organization violate.

This Decree took effectively from the date of issuance.